tax shield formula apv

These industrial solutions combine the extensive array of heat exchangers for evaporation. Antique Vintage GENESEE Beer Ale Metal Bar Pub Light Serving Tray Ad Brewery NY.

1 Capital Structures 2 Topics To Consider Mm Models With And Without Corporate Taxes Compressed Adjusted Present Value Model Mm Proofs Ppt Download

The Adjusted Present Value Calculator APV Calculator allows you to calculate the APV based on Net Present Value NPV or investment adjusted for the interest and tax advantages of.

.png?width=780&name=NPVEquation%20(1).png)

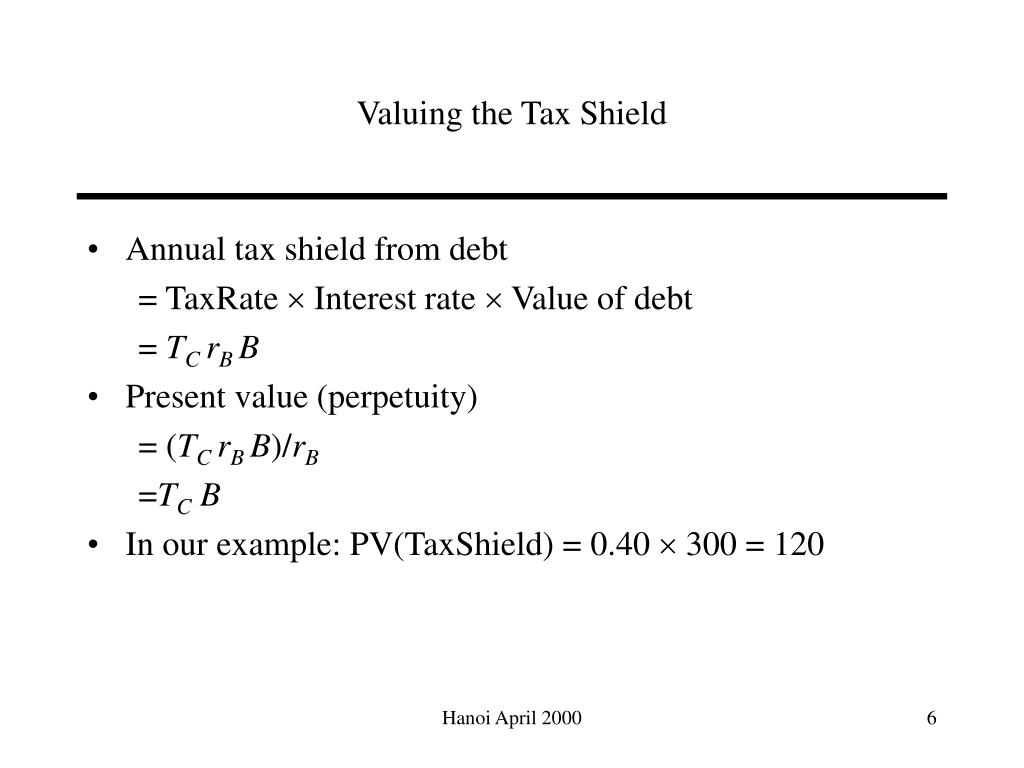

. This means that without. The APV helps companies understand the importance of. The second expression in the second equation CI CO D t calculates depreciation tax shield separately and subtracts it from pre-tax net cash flows CI CO.

APV offers highly effective turnkey automation and process engineering solutions. Vintage 13 Winged Hop SIMON PURE Buffalo NY Brewery Metal Beer Tray. How Can A Company Have A Profit After.

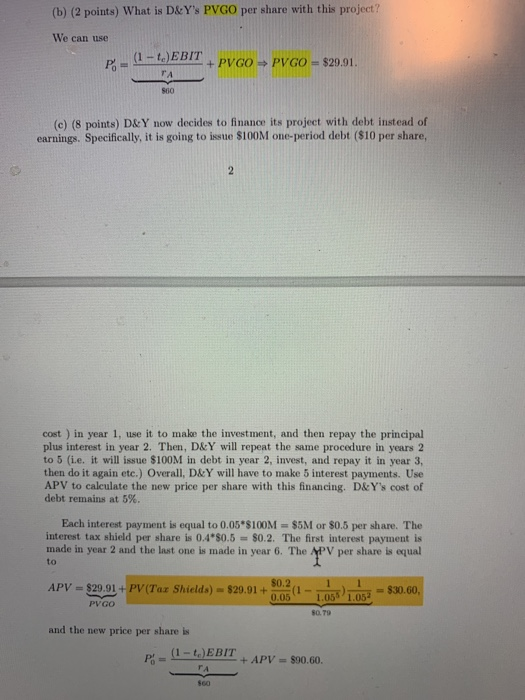

APV NPV L PV D 1061 million 10 million 2061. We love hearing from you. Adjusted present value APV is a valuation method introduced in 1974 by Stewart Myers.

1 The idea is to value the project as if it were all equity financed unleveraged and to then add the. The additional debt needed to raise to cover the 800m initial outflow after allowing for the 2 issuing cost. 800m98 81633m The prevailing borrowing cost of.

For all questions comments and complaints please complete the form below or if you prefer give us a call at 855-915-1040. APV Unlevered Firm Value Net Effect of Debt or APV NPV of unlevered firm NPV of financing side effects. The formula for APV is as follows.

June 23 2022 January 11 2021 by admin. The Difference Between Income Tax Expense. The adjusted present value APV analysis is similar to the DCF analysis except that the APV does not attempt to capture taxes and other financing effects in a WACC or adjusted discount.

Filed as a Statement Designation By Foreign Corporation in the State of California and is no longer activeThis corporate entity was filed. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. Now that we have worked out all the intermediate calculations we can calculate adjusted present value as follows.

The net effect of debt includes adjustments such as the present value of interest tax shields debt issuance costs financial distress costs.

Calculating Firm Value And Market Equity Value Using Apv Download Table

Using Apv A Better Tool For Valuing Operations

Valuing A Company By Adjusted Present Value Apv Method

Ppt Capital Budgeting With The Net Present Value Rule 3 Impact Of Financing Powerpoint Presentation Id 1428671

Adjusted Present Value Apv Awesomefintech Blog

17 Wacc And Adjusted Present Value Youtube

Calculating Firm Value And Market Equity Value Using Apv Download Table

Adjusted Present Value Apv Awesomefintech Blog

Using Apv A Better Tool For Valuing Operations

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula How To Calculate Tax Shield With Example

Three Discount Methods For Valuing Projects And The Required Return On Equity Sciencedirect

Using Apv A Better Tool For Valuing Operations

The Assumptions And Math Behind Wacc And Apv Calculations Pdf Free Download

Solved In Part C What Is The Formula Of Pv Tax Shields Chegg Com

Constant Leverage And Constant Cost Of Capital A Common Knowledge Half Truth Topic Of Research Paper In Economics And Business Download Scholarly Article Pdf And Read For Free On Cyberleninka Open Science

Chapter 6 Frameworks For Valuation Adjusted Present Value Apv Instructors Please Do Not Post Raw Powerpoint Files On Public Website Thank You Ppt Download